Table of Contents

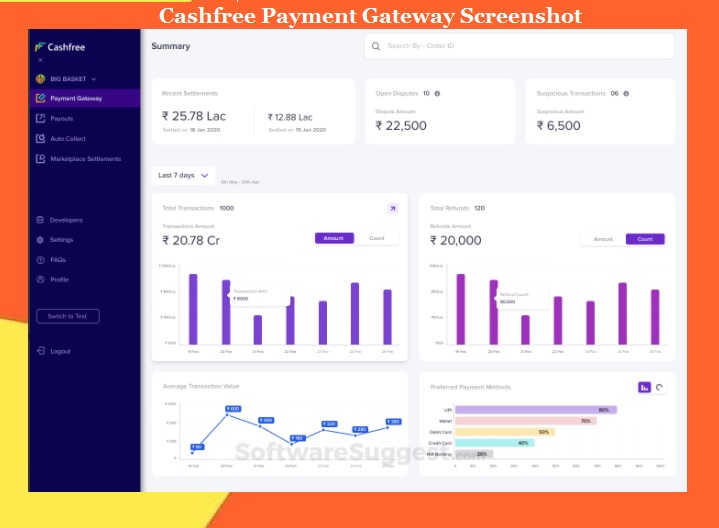

Cashfree Payment Gateway

Cashfree Payment Gateway tools makes it easy for the customer to do the payment online for the goods and services that the customer purchase from e-commerce websites or apps.

In the present time, online Payment Gateway tools are one of the crucial software tools used in the market.

There are various payment gateway tools are available now a days. Each payment gateway has some unique features. Cashfree Payment Gateway is also one of them. Cashfree payment Gateway software is one of the widely used payments in India.

Table of Content

In this tutorial we will discuss the following facts and information about cashfree payment gateway.

- Cashfree Payment Gateway Overview.

- Cashfree Payment Gateway Features.

- Pros and Cons of Cashfree Payment Gateway.

- Cashfree Payment gateway Integration.

- Cahsfree Payment Gateway Charges.

Lets start with the introduction of Cashfree payment gateway.

Cashfree Payment Gateway Overview

Cashfree is a payment gateway that is widely used in India and it helps Indian businesses to make and receive payments.

Currently, Cashfree is used by more than 50000 vendors for various purposes such as vendor payouts, wage payout, and bulk refunds.

Cashfree payment gateway is developed by a Bangalore-based company. Mr.Akash Sinha and Reeju Datta launched the Cashfree payment Gateway in 2015.

This is Bangalore based company. State Bank of India has been also invested in Cashfree.

Payment gateway solution providers such as Easebuzz, Razorpay, Instamojo, YAP, Y Combinator-backed Decentro, and PayU are competitor of Cashfree.

Some leading companies of the internet world such CRED, BigBasket, Zomato, HDFC Ergo, Ixigo, Acko, Zoomcar, and Delhivery among are the customers of Cashfree.

Due to its advance features Cashfree payment gateway is also known as the next-generation payment Gateway.

Cashfree payment gateway provides the highest number of pay later options including OLA Money, ePayLater, ZestMoney, and multiple bank EMI options.

Cashfree also provides support to various eCommerce CMS systems. WooCommerce and Magento themes can be easily integrated with Cashfree.

Cashfree provides the fastest billing cycles and instant refunds for businesses.

With Cashfree money can be received in more than 100+ payment modes such as Rupay, UPI, IMPS, and other wallets. With seamless checkout, product hosting, and pre-authorizations.

According to a report prepared by Cashfree organization, in present time Cashfree makes more than 4 million transactions every day. The numbers of transactions have increased by 50% in the last few months.

Some other platforms such as Coin base and Regular Pay platforms ahs some support problems where as cash-free offers exceptional support to the businesses merchant. It helps them to accept and send payments of domestic and international payments.

Cashfree also provides subscriptions for outstanding billings and repetitive payments. Additionally, Cashfree also emanates auto collect to reconcile payments for splitting the commission with vendors.

Cashfree Payment Gateway Features

Cashfree has various features that make it easy to use and more popular. Some of the important features of Cashfree are as follow –

1. Pre – Authorization

Pre-authorization is the process of authorizing and capturing the money while making the transaction using a Card. This facility is available in Cashfree Payment Gateway to merchant to block some amount of funds at the time order place by customers.

Merchants use this facility to temporarily hold some of the customer fund but merchant charge only once at the time of delivery.

2. Dynamic Descriptors

Merchant can associate a description and with it’s product and services through dynamic descriptors. Merchant can use dynamic descriptors to let their customer know what they bought.

Additionally, a merchant can also use the dynamic descriptor to describe a particular payment as per transaction basis. The use of dynamic descriptors prevents fraud and reduces the chargeback. Dynamic descriptors feature available in Cashfree Payment Gateway also ensures the recognition of charge by adding context to customer’s statement.

3. Checkout

Checkout form available in Cashfree Payment Gateway feature of offers customers a streamlined flow of initiating the payment.

Using this checkout form customers can place the correct order, amount, and customer detail.

This checkout form redirects the customer to the Payment screen of the Cashfree Payment gateway.

Customer no needs to worry about navigating to any third party while using the checkout of Cashfree payment gateway. Cashfree provides multiple ways of integration Checkout can be customized.

Merchant can add UPI integrations including Webflow, intent flow, Google Pay integration, and UPI SDK integration.

4. Secure Vault

Cashfree payment gateway provides the facility to merchants to store the customer’s information in a secure vault of Cashfree.

Store cards provide a seamless checkout experience to customers.

Once customer detail is store in the store vault then the customer no needs to re-enter the detail again on next checkout.

Here it is an important note for a customer that the Customer’s Card CVV number is not stored in the vault and fully PCI-DSS Compliant. Cashfree Vault is secure.

5. Dynamic Routing

To make a transaction successful routing techniques should be efficient because inefficient routing leads to a failed transaction.

Dynamic Routing Mechanism is implemented in Cashfree payment gateway therefore chance of transaction failure is reduced.

Additionally, dynamic routing implemented in Cashfree Payment Gateway also reduces the transaction latency which provides a great experience to the customer.

6. Security

Security is one of the major concerns for the customer while making the payment online. Cashfree provides a secure way to it’s customer to transfer money.

Due to High-level Security feature of Cashfree it is widely used by everyone from an individual freelancer to both small and large organizations.

Cashfree use PCI-DSS compliance that enhances the security level. It keeps your password secure. Cashfree payment gateway also maintains the security of APIs.

Cashfree also supports Two-factor authentication. Cashfree take customer reports to fraudulent activity very seriously. In such situations Cashfree provides immediate technical support to the customer.

7. Plug and Play

Plug and play solution is new for payment gateway. Plug and Play solution for payment management is specially implemented to full fill the need of internet merchants.

Cashfree also provides support for ready-to-use plugins for companies like Shopify, open cart, and Prestashop.

The key feature of Plug n Play is that it enables the merchant to expand their business to greater heights without compromising security. Plug and Play facility provided by Cashfree reduces the dependency on cash transactions and some other infrastructure limitations

8. Good Customer Support

24*7 customer support through phone call, email and chat is available for the customers. Customers can selects to pay in these currencies provided that the merchant has provided all the appropriate documents and gained approval from the banking partners.

Pros of Cashfree Payment Gateway

Various Pros of Cashfree Payment Gateway are as follow-

- The Payment success rate of Cashfree Payment Gateway is higher for the both domestic and international transactions as compare to some other payment gateway.

- It Improves Customer Trust. Sometimes a customer might not feel safe to proceed with the transaction if the security level is low. Since Cashfree is widely used by both small and large organization and it’s high-level security feature improve the Customer trust.

- Cashfree Provides Analytical Data.

Cashfree payment gateway also provides various kinds of data to the merchant. The type of data that is provided by different payment gateways may vary. Each provided data has its use during the data analysis process.

Merchants can use this data in making decision or business policy to improve their business.

- Cashfree payment is Good and cheaper than some other payment gateway.

- Cashfree work faster and it is simple to use it.

- Cashfree provides a facility to merchants to verify the bank accounts of their customers, including the account and holder name before any money is sent.

- Cashfree accepts mobile payment directly on the customer’s mobile handset.

- With Cashfree Merchant can accept the payment in multiple currencies

- Cashfree can automatically track customer payments with a virtual bank account.

- Automatically spilt the commission with the vendor after every purchase.

Cons of Cashfree Payment Gateway

There is always an area of improvement in payment gateway development. Cashfree also has some areas of improvement or we can say Cons in the current version. Some cons of using Cashfree based on customer feedback are as follow-

- Cashfree does not have Amex activated for international transactions.

- UI part should be improved.

- Sometimes Cashfree payment gateway takes more time to verify and activate the account.

Cashfree Payment Gateway Charges and Pricing Plan

Pricing Plan of Cashfree payment gate for various service is as shown in the following table

| Parameter | Remark |

| Payment Gateway |

1.75 % per transaction for 70+ net banking. 2.5% per transaction for late payment or cardless EMI 3.75% + 7 Rs per transaction for international cards. Standard payment gateway charges are applicable. |

|

Payout |

Visa , Mastercard : RS 10.0

AmazaonPay: wallet 1 % Paytm Wallet: 2.25 % |

| Bank Account Verification | Rs 2.50 per validation

APIs to check account validity and account holder name Also verify UPI Id. |

All plan of Cashfree includes the following –

- Paperless and same day onboarding

- Easy to use dashboard

- Instant Verification

- Developer’s friendly integration kit.

Conclusion and Summary

Finally, we can say that Cashfree Payment Gateway has some advanced features that make it popular and easier to use, increase the success rate of the payment transaction. Security mechanisms are also efficient.

Therefore Cashfree is the best option in India for individual freelancers and both small and large business organization.

I hope that various information such as cashfree payment gateway features , cashfree payment gateway charges , cashfree payment gateway review , cashfree payment gateway integration in php provided in this post will be help for you to enhance your knowledge.